If willpower isn’t cutting it, try these savings tips supported by research.

Top 4 Science-Supported Savings Tips

See how these simple tips can impact your wallet.

- Visualize Your Budget

- Save One Step at a Time

- Automate Your Savings

- Save Big Sums When You Have Them

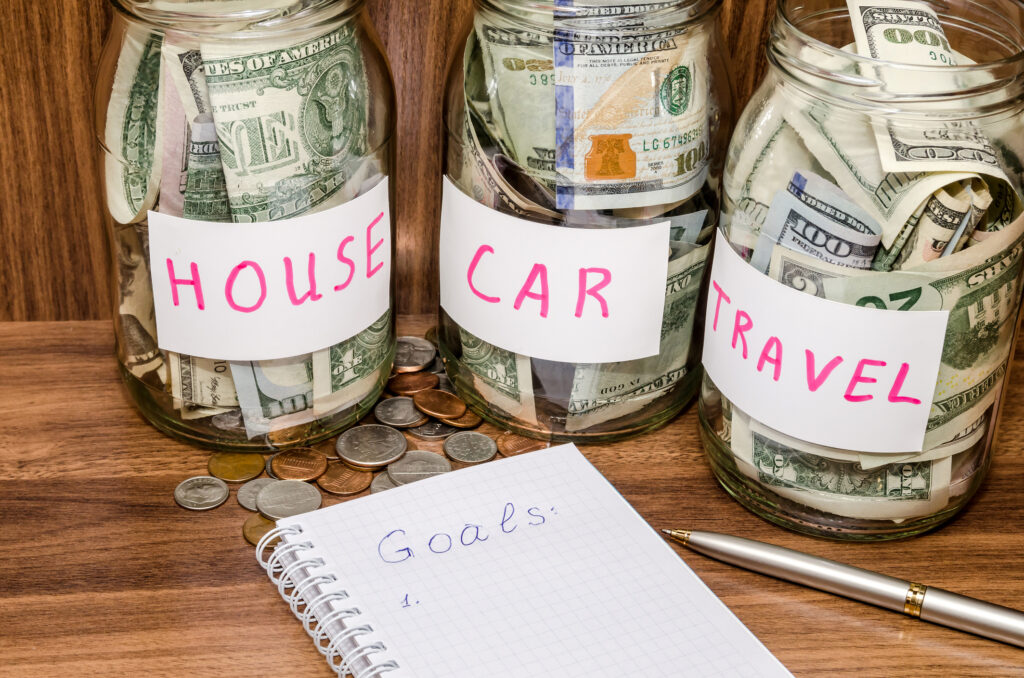

Visualize Your Budget

Keeping track of your money can be difficult when everything is online. The solution? Create a visual budget that you can turn to.

Visual graphics make it easier to process and internalize information, and you should be using them to your advantage when setting you money goals.

This takes a lot of upkeep, but it’s worth it. Track your spending with charts and graphics and create savings trackers. Do everything you can to visualize your goals.

Save One Step at a Time

One of the most important aspects to setting savings goals is to make them attainable. If you’re putting off your savings because you’re overwhelmed, it’s time to take a step back to compartmentalize and break down your big goals.

Take the weight off of your shoulders. Carrying around a big financial goal with no specific direction isn’t doing you much good.

Instead of setting a goal to “save for a down payment” try “save the first 10% of a down payment by March” and see what happens.

Breaking up your big savings goals into smaller sub goals can keep you from abandoning them. When setting goals, make them SMART. That is, specific, measurable, achievable, relevant, and time bound.

Automate Your Savings

You’re less likely to actually dedicate your money to your savings accounts when you have to divvy up the paycheck yourself.

Whenever possible, automatically. Divide your paycheck so you cash goes straight to where it needs to be. Your savings will grow in the background of your life.

Experts recommend that at least 20% of your paycheck go to your savings, so start there and increase that percentage as your earnings grow.

Save Big Sums When you Have Them

Studies show that we treat large sums of money differently than the regular eb and flow of our monthly earnings. Whenever you get a large sum of cash like a tax return or inheritance, you’re more likely to treat it with care.

Put bigger lumpsums of cash directly into your savings. This is one of the best tips to jumpstart your savings when you need it most.

Then consider this mindset with all other cash sums. Your paycheck may be regular, but it’s just as precious. Truly understanding the value of money is one of most important steps to take on your financial freedom journey.

Create a new cash philosophy and stick to it. This will help you re-contextualize your idea of wealth and motivate you to carry out your financial ambitions.

In Conclusion

You have the power to meet your money goals, and these tips might even get you there faster. It’s important to stay focused while you’re saving for something big, and it’s never too late to make some extra cash to supplement your savings.

Contribute more to your savings by earning extra cash in your free time by following our tips.